Part 2: The State of Freight

This chapter provides an overview of the NSW port and freight sector, outlining the challenges and opportunities statewide, in Greater Sydney and in regional NSW

The NSW freight and ports sector at a glance

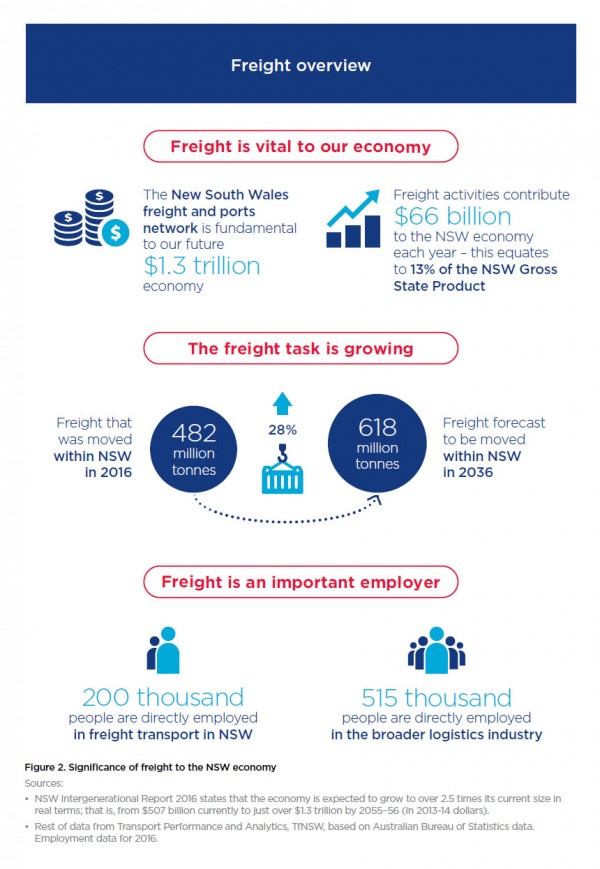

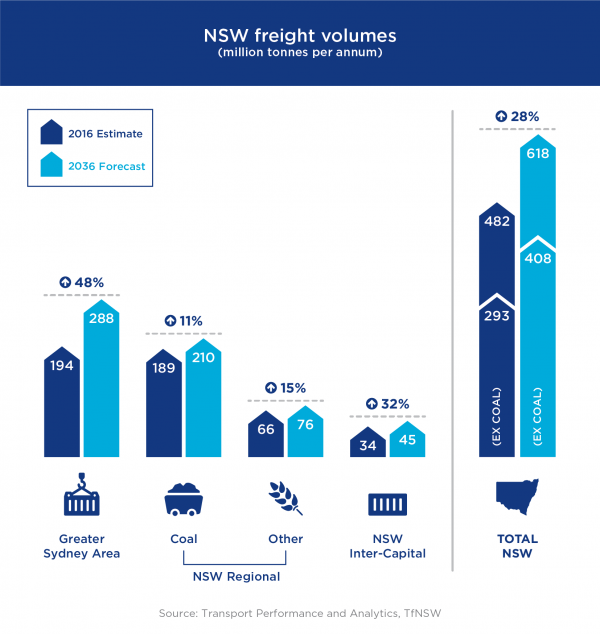

The NSW freight and ports network is fundamental to the State’s future $1.3 trillion economy. In 2016 over 480 million tonnes of freight needed to be moved in NSW. This is forecast to increase by 28 per cent to 618 million tonnes by 2036.

Growing freight volumes

The largest growth in freight volumes in NSW will occur in Greater Sydney, which will see the freight task increase by almost 50 per cent by 2036. The major drivers of the huge increase in the overall freight task in the next 20 years will be:

- population growth

- economic growth, resulting in increases in freight movements over and above the rate of population growth

- growth in global commodity demand.

Growing demand from Asia

Rising populations and incomes in Asia drive increased demand for premium agricultural products, which in turn provides increased opportunities for NSW producers to export their products. Freight network efficiency and connectivity is critical to realising these opportunities.

The NSW Government has set a target to contribute to achieving a 30 per cent growth in the value of NSW primary industries in NSW by 2020, with much of that growth being export focussed.

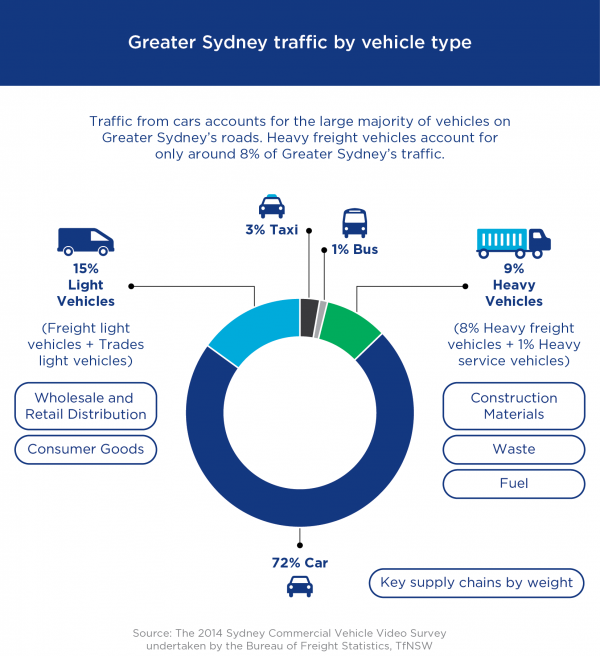

The State’s major commodities for freight

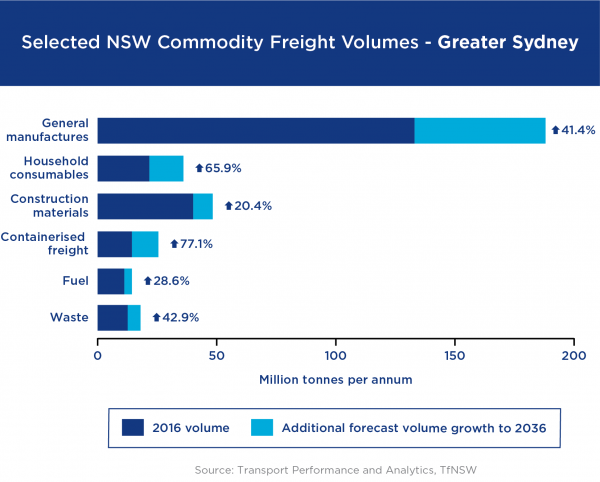

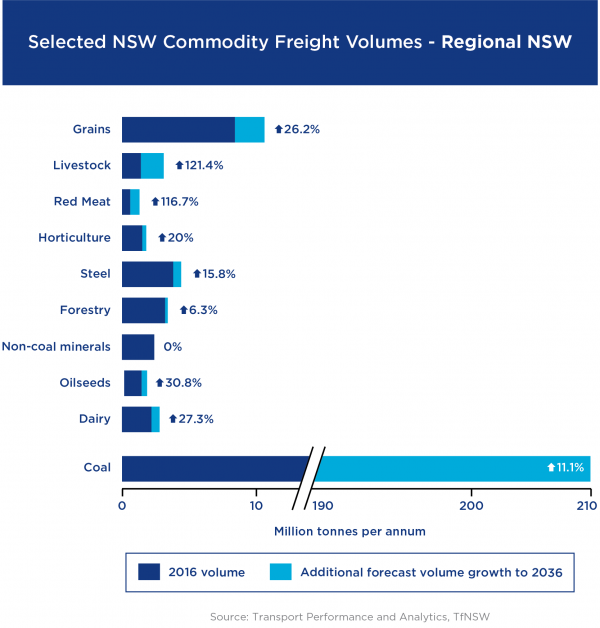

Freight supply chains in NSW are currently dominated by the movement of a number of high volume commodities – this is expected to remain the case to 2036 and beyond. In Greater Sydney, the dominant commodities are manufactured goods, construction materials, consumer goods and waste. In regional NSW, the dominant commodities are coal, grain and steel, forestry and other agricultural produce.

Large numbers of smaller deliveries are equally important to the overall supply chain, such as deliveries between small businesses and consumers that are driven by e-commerce, which is expected to grow significantly.

Overview of the freight network

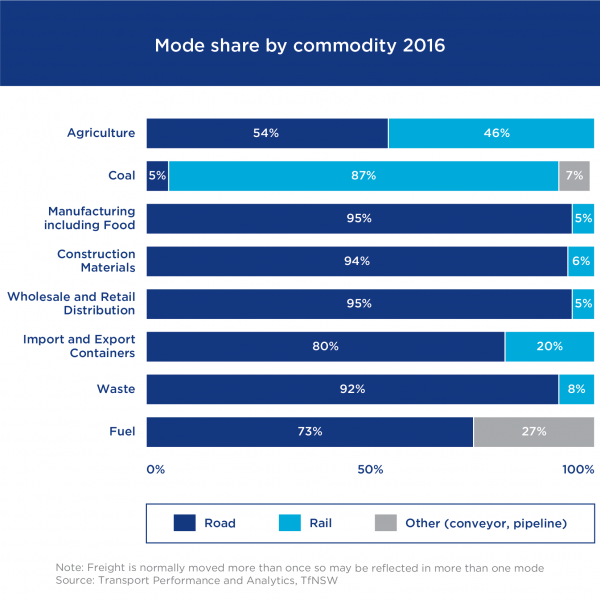

The NSW freight network is made up of ports, shipping channels, airports, prescribed airspace, roads, rail lines, pipelines, intermodal terminals and freight-related precincts. As shown in Figure 5, the majority of freight is moved by road. The major exception is coal, which is generally transported by rail. In addition, almost half of NSW agricultural produce is moved by rail.

There are opportunities to improve freight efficiency by shifting some commodities away from road transport to:

- rail, which is well-suited for transporting containerised freight, such as agricultural exports and construction materials, over longer distances

- coastal shipping, which is well-suited for transporting construction materials and other bulk freight.

Roles and responsibilities in the freight and ports sector

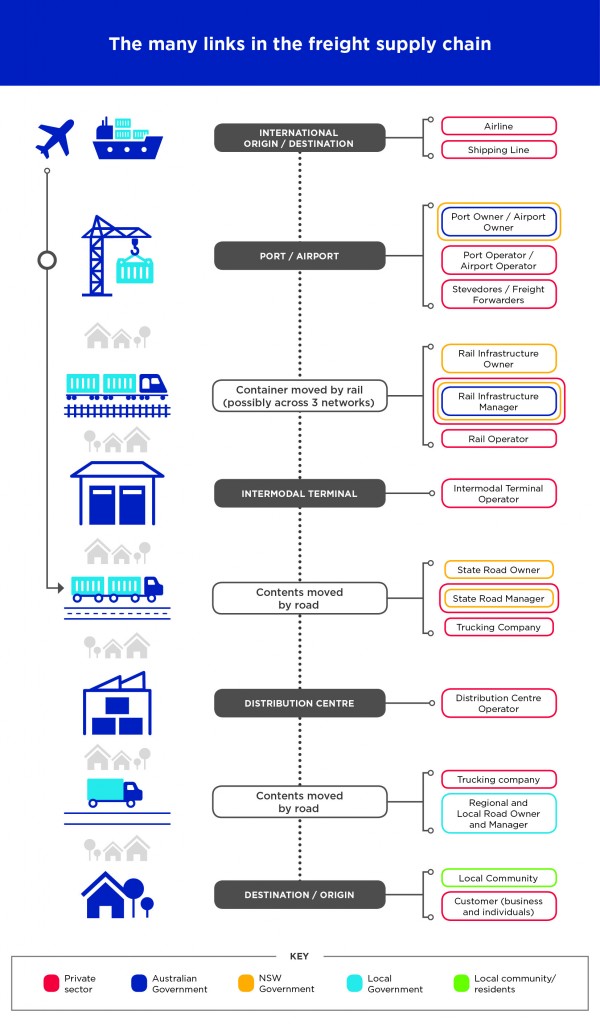

There are a large number of government and industry stakeholders involved in the movement of freight across the NSW network.

While this Plan sets out the NSW Government’s priorities for the freight network - many of the initiatives in this Plan depend upon collaboration with industry, local governments and the Australian Government.

At many points in the supply chain these stakeholders have a significant part to play - particularly at our ports and airports, and on our rail network which involve high levels of co-ordination.

Important shared responsibilities

Infrastructure ownership and management

Local councils, the Australian Government and industry, as well as the NSW Government own and manage transport infrastructure.

The role of the government in relation to major infrastructure assets leased to and managed by private entities (such as rail networks, Port Botany, Port Kembla and Newcastle Port) is to ensure participants in the supply chain have access to them and monitor pricing and compliance with lease agreements.

The NSW Government will continue to plan for and invest in new and improved freight networks.

Embracing technology that improves efficiency and saves lives

Industry has embraced efficiency and safety enhancing technology such as higher productivity heavy vehicles, in-vehicle telematics and automation in warehouses and at ports. It is also exploring the use of developing technology, such as drones in freight deliveries and blockchain in supply chain monitoring and payment functions.

The NSW Government also has an important role to play in:

- adopting technological solutions to issues such as infrastructure capacity constraints (for example Smart Motorway technology) or the need for better co-ordination of the various participants in the freight supply chain (for example a mobile phone app displaying live cargo movements at Port Botany for truck operators and others)

- fostering an environment where technology is embraced, by bringing together technology companies, academia and the freight industry to co-create technological solutions to real-world problems in the freight network, through for example the NSW Government’s Sydney Startup Hub

- ensuring that regulation does not hamper innovation.

Employment

The freight industry, employers and government will need to work together to:

- grow jobs in the sector and assist those whose jobs are replaced by new technology to develop the necessary skills to fill the jobs of the future

- embrace greater representation of women, Aboriginal and Torres Strait Islander people and other under-represented groups in the freight industry.

The Austroads review of the National Heavy Vehicle Driver Competency Framework published in May 2018 was undertaken in consultation with a range of stakeholders including the heavy vehicle industry. The review examined heavy vehicle licence progression, waiting periods, minimal driving experience and options to fast track heavy vehicle licence progression.

Austroads will assess the feasibility of the recommendations, including impacts on road safety, in consultation with road agencies with a view to developing a nationally consistent approach to deliver greater benefits to industry through improved licensing arrangements for heavy vehicle drivers.

Safety

Australia has established national regulators with responsibility for heavy vehicle, rail, shipping and commercial vessel safety. The NSW Government and local Councils are the managers of the NSW road network. The NSW Government has responsibility for road rules and other regulation of the road network, working with national bodies including the National Heavy Vehicle Regulator. It is also responsible for ensuring the safety of rail infrastructure and some aspects of maritime safety (including commercial, recreational vessel and maritime infrastructure safety).

Participants in the freight supply chain have a significant role to play in adopting safe work practices, considering the safety of others and complying with safety laws (such as Chain of Responsibility (COR) requirements for road transport which place safety obligations on all parties involved in the movement of freight across supply chains).

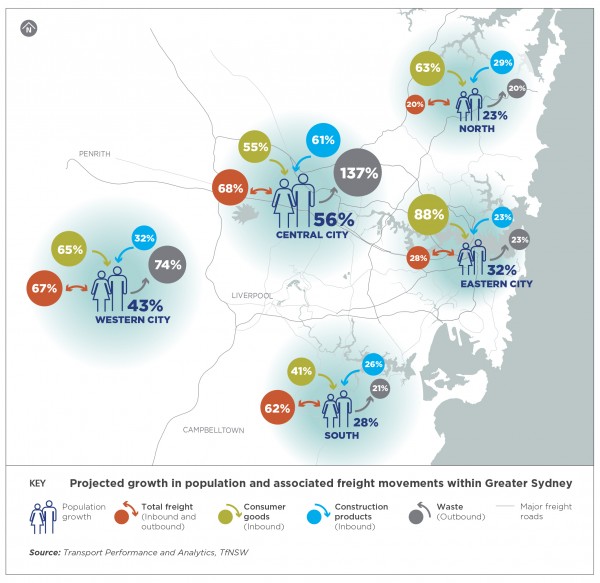

Greater Sydney production and freight movements

The Greater Sydney freight task is significant. Not only does the city’s freight network support the demands of its growing population, it also plays a vital role in connecting the State and the rest of the country to international markets.

Freight volumes moving through the city each year are expected to increase by about 50 per cent by 2036.

Changing freight demand in Greater Sydney

Greater Sydney’s freight task is being transformed by population and economic growth and changing consumption patterns. Figure 7 shows projected changes in commodity movements associated with population growth and increases in household consumption for each part of Greater Sydney. Some of the key trends behind the forecasts are described below.

Construction materials moving over greater distances

To support Greater Sydney’s growing population, there will continue to be strong demand for construction materials for new infrastructure, and residential and commercial development.

The distances over which construction materials need to be transported is growing as local resources are depleted, with increasing volumes now sourced from the South East and Tablelands (Southern Highlands), Central Coast and Illawarra-Shoalhaven regions.

Increasing consumer deliveries

Last year, online retail sales to Australians were valued at $24.2 billion, 7.8 per cent of the traditional retail “bricks and mortar” retail sector. The level of sales was 10.1 per cent higher in December 2017 than a year earlier. The number of high value freight movements in Greater Sydney will continue to grow alongside the growth of e-commerce. It is estimated that every five years e-commerce sales will double. This will add to urban congestion as delivery vehicles compete with other vehicles for finite road and kerbside space.

Managing growing volumes of waste

Greater Sydney’s waste volumes will increase as the population grows. As the city’s existing landfill capacity is depleted, waste will increasingly need to be transported to consolidation points within Greater Sydney before being transported further afield.

The Greater Sydney freight network

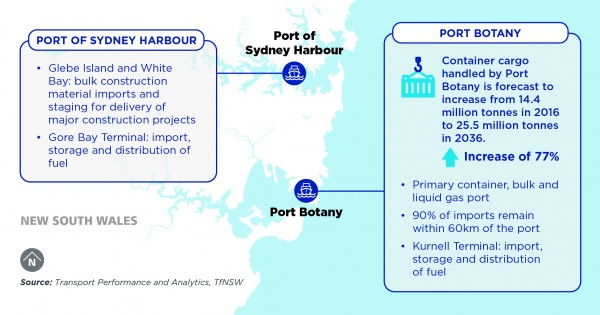

Ports

Sydney is home to Port Botany and the Port of Sydney Harbour which includes Glebe Island, White Bay and Gore Bay Terminal (see Figure 8).

Port Botany plays a major role in the NSW economy as a gateway for international trade. It is the primary container port and NSW’s primary bulk liquid and gas port. Glebe Island and White Bay support the transport of construction materials into Sydney. The efficient operation of Sydney’s ports relies on:

- strong co-ordination between port owners, stevedores, road and rail managers and service operators

- managing congestion on the connecting roads and rail infrastructure

- ensuring there is sufficient ‘landside’ capacity for freight, which is particularly important for Port Botany given population growth in the Eastern City and the other land uses in the precinct that also generate freight movements.

Coastal Shipping

Coastal shipping can be a viable alternative to road or rail for certain types of freight. The Glebe Island and White Bay precinct is uniquely placed to enable shipping of sand and aggregate to Sydney to service the needs of Greater Sydney’s construction boom. This removes the need for trucks to travel into central Sydney with sand and aggregate from outside the area. Coastal shipping is also increasingly being looked at as an attractive option for moving less time sensitive freight from NSW to other states.

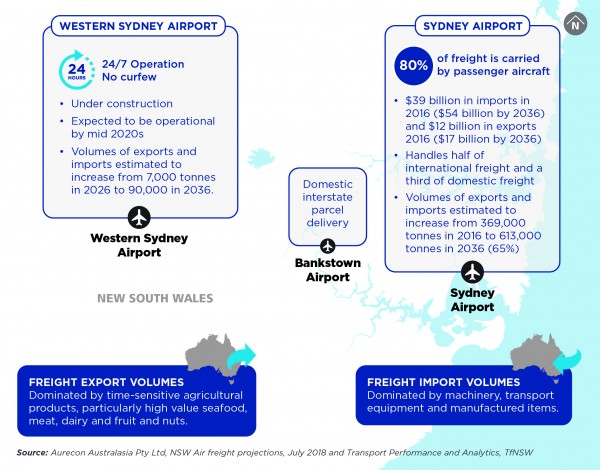

Airports

Most air freight (about 80 per cent) is carried in the hold of passenger planes, with the remainder being transported by dedicated freight aircraft.

To support the growth in air freight, a range of constraints will need to be addressed, including:

- congestion on the road network around Sydney Airport, and

- curfew restrictions which currently limit the type of aircraft permitted to operate overnight freight services to older and smaller aircraft (when larger more modern aircraft may meet desired noise standards). These restrictions do not exist in other airports, such as Melbourne, Perth, Brisbane and Canberra. This means that an entire payload may need to be unloaded and re-loaded on to a different aircraft to reach Sydney on an overnight flight, using a smaller, noisier and less efficient aircraft.

Creating a freight precinct at Western Sydney Airport

The development of the Western Sydney Airport offers a great opportunity to create a state-of-the-art freight precinct, which will create new export opportunities such as premium agricultural produce exports from regional NSW.

The NSW Government is working to realise such opportunities by partnering with the Australian Government to attract transport and logistics industries to the area.

The NSW Department of Primary Industries is progressing the development of options for an Agribusiness Precinct at the new Western Sydney Airport looking to address the policy, infrastructure, technology and user needs of the precinct. This precinct is aligned to a proposal put forward by NSW Farmers Association, together with KPMG for a Fresh Food Precinct close to the airport, which noted the need to integrate high value food production with new food processing technologies to support the development of new agricultural export markets.

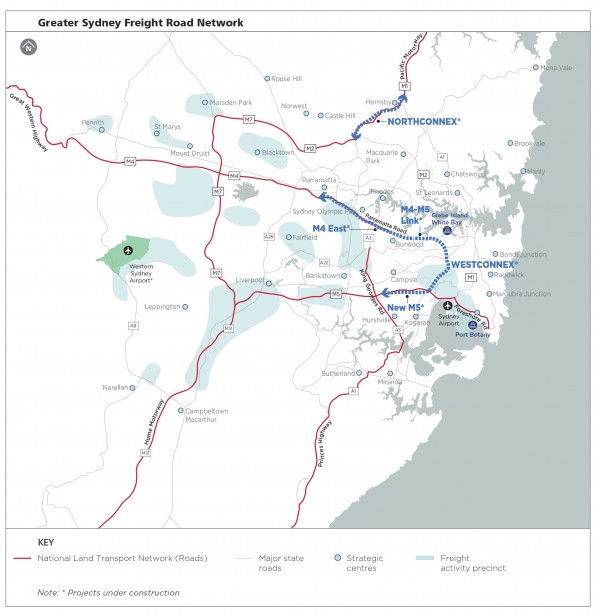

Greater Sydney roads

About 80 per cent of the Greater Sydney freight task is undertaken by road.

Greater Sydney’s key freight corridors

| Pacific Motorway | Hume Motorway |

| M4/Great Western Highway | M5 East |

| M5 West | M7 Westlink |

| Parramatta Road | Foreshore Road |

WestConnex and NorthConnex will also become major parts of the freight network once completed.

Congestion driving up freight costs

Congestion contributes to the cost of moving freight. The Bureau of Infrastructure, Transport and Regional Economics (BITRE) estimates that the cost of avoidable congestion in Sydney was $6.1 billion in 2015 and projects this to increase to between $9.5 billion and $12.6 billion by 2030.

As traffic volumes increase, it will be necessary to manage congestion for key freight areas, particularly:

- around Port Botany and Sydney Airport, supporting the growth of international trade

- on the M5 West, which carries large volumes of both passenger and freight traffic

- on the M4/Great Western Highway, which carries freight from the Central West

- around major freight terminals and depots, including Enfield, Chullora, Moorebank, Yennora and the proposed Western City intermodal terminal

- on the M1 Pacific Motorway and A1, to support forecast increases in freight movements to the south.

Congestion will also need to be managed in high-density urban areas, whose roads are being used by increasing numbers of light vehicles delivering goods to homes and businesses. These light vehicles are facing growing competition for both road space and for kerbside parking to allow for pickups and deliveries.

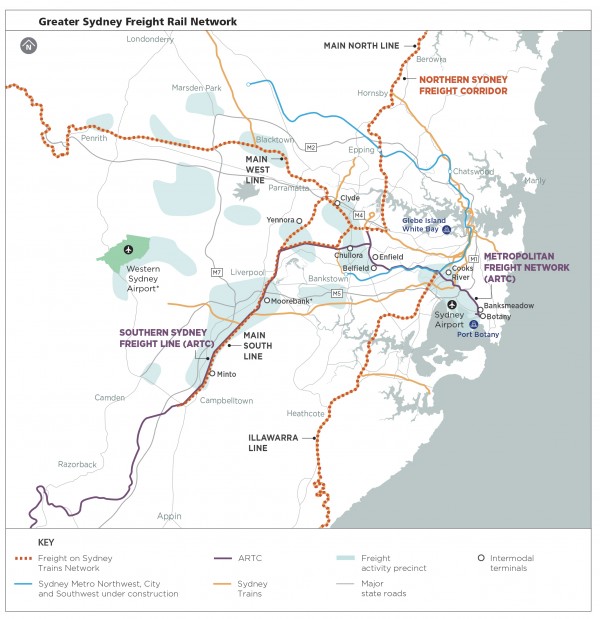

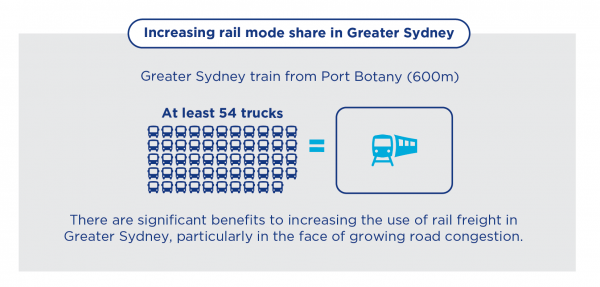

Greater Sydney rail network

Rail is generally used for transporting high volume commodities across larger distances. The main commodities transported by rail in Greater Sydney include:

- aggregates (sand and quarry material) to Sydney

- construction and household waste transported from transfer stations in Sydney

- import and export containers passing through Port Botany to and from intermodal terminals across NSW

- interstate and regional cargo (including coal and steel) moving to or through Sydney.

Significant rail freight capacity upgrades in Sydney include:

- Port Botany Rail Line Duplication - the last three kilometres of railway line to Port Botany

- Cabramatta Loop - passing loop to support operations at Moorebank Intermodal Terminal

- Western Sydney Freight Line - corridor protection for future rail connections to serve Western Sydney Airport, Western NSW and Port Botany.

Freight competing with passenger services on the rail network

On the Sydney Trains Network, approximately five per cent of rail paths are allocated to freight, with another four per cent made available on an ad-hoc basis. NSW legislation requires that passenger trains are given reasonable priority.

Use of rail services across the greater metropolitan area has increased significantly in recent years, with patronage growing 6.9 per cent between 2015-16 and 2016-17, and 27.1 per cent over the five year period before 2016-17. As the population and rail patronage continues to grow, so too will competition for access to the shared rail network.

Timetabling of freight and passenger services can involve negotiation between the three rail infrastructure managers and Transport for NSW. More efficient allocation of train paths can be achieved through more timely exchange of information and the inclusion of freight rail operators.

Reducing avoidable rail freight delays

Freight trains miss their scheduled paths on the rail network due to various reasons including, network performance, infrastructure, weather and loading issues. Breakdowns and mechanical issues also prevent optimal operation - but only 10 per cent of these delays are avoidable.

Intermodals essential for increasing rail freight

Intermodal terminals within Greater Sydney are critical for increasing the utilisation of the rail freight network, particularly containers to and from Port Botany. There are a number of metropolitan intermodals under construction, including the Moorebank Intermodal Terminal.

While the NSW Government does not have a role in operating intermodal terminals, it can play a role in identifying, protecting and zoning land for intermodal terminals and assisting with access through necessary road and rail link extensions.

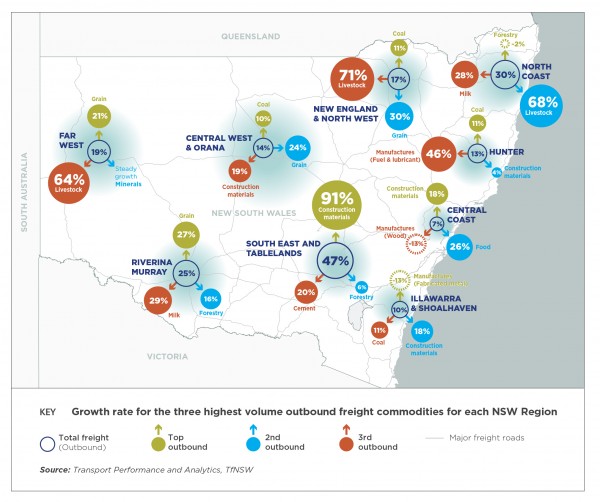

Regional NSW production and freight movements

Regional NSW accounts for 30 per cent of NSW’s Gross State Product (GSP) and 33 per cent of goods manufactured in NSW. Regional NSW’s freight task is forecast to grow by around 12 per cent by 2036 - from 255 million to 286 million tonnes. Figure 14 below shows the projected changes in the largest freight volume commodities for each part of regional NSW.

Specialisation of the regions

Economic activity in regional NSW is becoming increasingly specialised, with the regions producing fewer types of goods and focusing on exporting outside of their region. Some key trends impacting on the major commodities referred to in Figure 14 are described below.

Coal

Movement of coal for export, local power generation and steel manufacturing makes up 74 per cent of the total regional freight task. Coal contributes approximately $7.6 billion in regional NSW, with two-thirds of this value ($5 billion) coming from the Hunter region. Coal freight volumes, however, are expected to grow less rapidly than other regional commodities over the next 20 years.

Agriculture and livestock

Export and domestic grain movements represent the second biggest freight task by volume in regional NSW after coal, at 4.2 per cent of the regional freight task. The major areas of production are the Riverina Murray and New England North West and Central West Orana.

Livestock production is also forecast to grow significantly at an average annual rate of around 4 per cent, or more than doubling in volume over the next 20 years. A similar major increase is therefore expected for transport movements of livestock and meat from the producing regions (Hunter, New England and Northwest, North Coast and Far East) to their markets, including both domestic and export consumers.

Other key agricultural commodities for regional NSW include forestry and timber products, horticulture, cotton, oilseeds, dairy products and wine.

Manufacturing

The Hunter and Central Coast regions have the most significant manufacturing activities outside of the Greater Sydney region. The Hunter also handles approximately 37 cent of fuel in NSW, which includes fuel from Port Botany transported by pipeline from Port Botany to Newcastle for distribution.

Construction materials

Construction material demand is significant in Greater Sydney and will continue to grow. As nearby resources are exhausted or cannot be developed for other reasons, future supply of quarry materials will need to be sourced from regions further afield including the Hunter, Illawarra and Shoalhaven.

Figure 14: Map showing forecast growth in the three highest volume outbound freight commodities in each NSW Region to 2036

The regional freight network

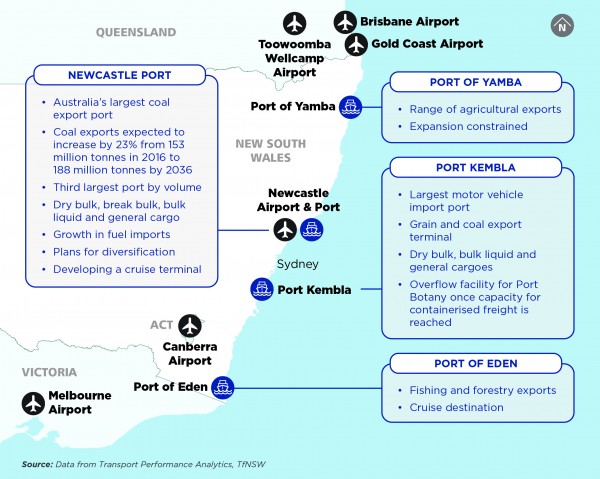

Ports

Regional NSW is home to four commercial ports: Newcastle, Port Kembla, Eden and Yamba. Of these, Newcastle Port and Port Kembla are responsible for the greatest trade volumes.

Newcastle Port

Newcastle Port is Australia’s largest terminal for coal exports. The co-ordination of activities of coal producers, rail service providers and terminal operators through the Hunter Valley Coal Chain has played a key part in growing exports through Newcastle Port.

The port’s leasehold owners, the Port of Newcastle, are planning to diversify and expand the port’s trade base. Medium to long-term constraints on this expansion include the pressures on the shared rail network in the Upper Hunter Valley and access via the New England and Golden Highways.

Port Kembla

Port Kembla is NSW’s largest terminal for vehicle imports and grain exports, and the second largest terminal for coal exports.

Port Kembla has been identified as the location for the development of a future container terminal to augment capacity at Port Botany when required.

Interstate ports

Producers in southern NSW may also choose to transport goods to the Port of Melbourne whilst producers in northern NSW may transport produce to the Port of Brisbane.

The NSW Government supports the use of rail for the movement of freight. While there is sufficient rail capacity in the short to medium term, freight rail access to Port Kembla is recognised by Infrastructure Australia as an initiative of national priority.

Regional airports

Regional airports play a relatively small role in the movement of freight but this may change in the future, particularly with the continued growth of e-commerce. In particular, regional airports with international services could provide opportunities for regional producers to reach overseas markets. Interstate airports such as Canberra Airport and Toowoomba Wellcamp Airport (in Queensland) are increasingly being used by NSW businesses for international air freight.

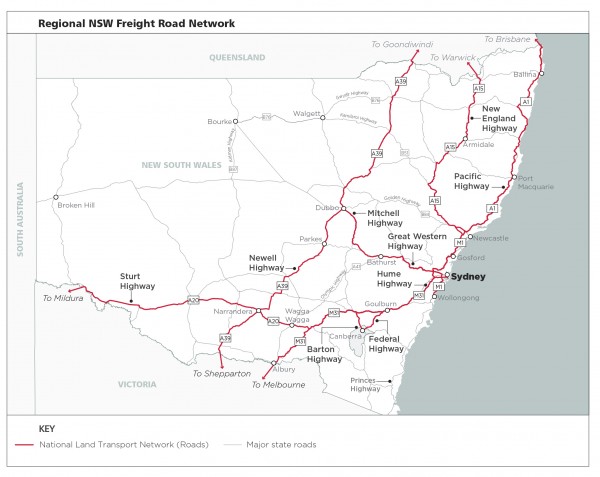

Regional Road Network

With the exception of coal, most commodities in regional NSW are transported by road – the Hume and Pacific Highways move the majority of the regional road freight task. Other important regional roads for freight include the Newell, Golden, Great Western, Sturt and New England Highways. These routes will continue to experience growth over the next 20 years.

Making regional roads more efficient and safer

The efficient movement of freight to and from Regional NSW will be supported by:

- improved east-west connections, including improvements to the Great Western and Golden Highways

- maintenance and capacity enhancements to make roads safer and more accessible for higher productivity vehicles, such as through improvements to road surfaces, lane and shoulder widths, intersections, level crossings and bridges and other safety infrastructure upgrades

- reducing the impact of flooding through better planning for roads through flood-prone areas, such as the Newell Highway.

Managing congestion around Gosford, Newcastle and Wollongong

The increasing number of freight distribution sites, together with growing populations, will result in more traffic around Gosford, Newcastle and Wollongong.

Roads with steep gradients, such as Mount Ousley near Wollongong, also pose challenges for heavy vehicles, although recent trials on this road have shown that high productivity vehicles (HPVs) are better able to handle these grades than existing vehicles.

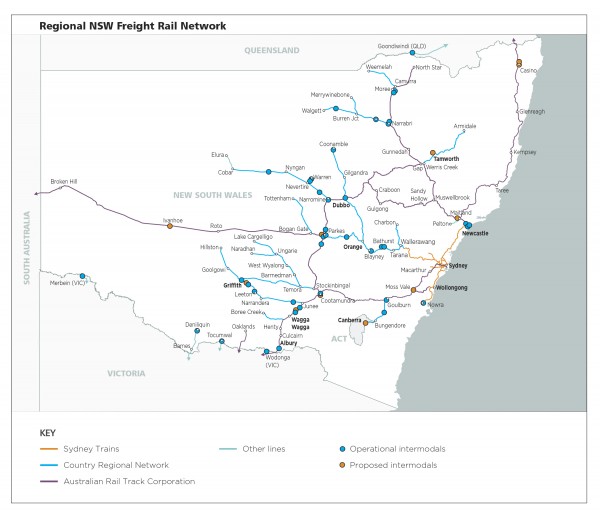

Regional NSW Rail Network

The regional rail network is used to transport coal and non-perishable agricultural products such as grain to ports and distribution centres. Rail is also increasingly used for bulk transport of construction materials and waste.

Improving the efficiency of freight rail

Issues that impact on the efficiency and capacity of the regional rail network include:

- limits on train speeds and capacities as a result of limits on axle weight capacity, track speed, and siding and passing loop lengths

- catering for the variability of agricultural produce, whose volumes change with the seasons and weather conditions – with good harvest seasons placing pressure on main rail lines and poor harvests reducing the viability of connecting lines

- pressure on shared networks from increased urban expansion towards the Southern Highlands, Blue Mountains and Central West, and Hunter Valley

- increased pressure on the Hunter Valley rail corridor with coal extraction moving further north

- increased pressure on rail networks in the south (the Main South Line and Illawarra Line) with greater production in this area and increasing reliance on rail.

- multiple network managers that rolling stock operators must deal with if transporting commodities across NSW by rail.

Parkes to become major freight hub through Inland Rail

The private sector is expected to invest in intermodal terminals along the Inland Rail corridor, with Parkes emerging as a major freight hub. Parkes is located within 12 hours by road or rail to 80 per cent of Australia’s population and has the only intermodal terminals in NSW that facilitate double stacking of containers to Perth.

Investment in improved east-west rail freight networks and connectivity with NSW ports will be critical for maximising the benefits of Inland Rail for NSW.

Regional intermodal terminals are critical to support container exports (including containerised grain) and improve regional supply chains.